I would constantly say I was eating enough and that being underweight was due to my high metabolism. I weighed 45kg, which was extremely underweight for my height of 5’6″.

This reminds me of my late teenage years/early 20s. If you are thinking, “my spending is fine and I am saving enough” please read on… I strongly believe that everyone needs this/a spreadsheet in their lives to turn wanting to save into actively saving. However, once you start using it, you will question why you lived so long without it. If you are serious about saving, this is one of those things that you think you probably do not need.

Your finance tracking spreadsheet will be the KEY to your saving success Why you NEED a Finance Tracking Spreadsheet

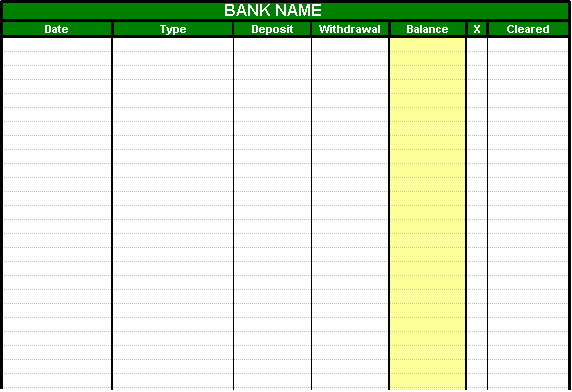

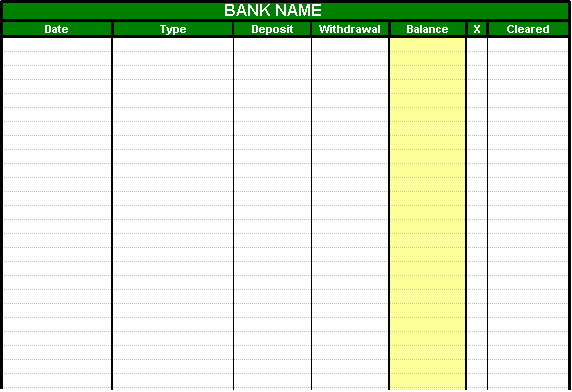

BANK ACCOUNT TRACKER EXCEL DOWNLOAD

Finance Tracking Excel Spreadsheet Download. What does a Good Finance Tracking Spreadsheet Look Like?. Examples of a BAD Finance Tracking Spreadsheet. Benefits of a Finance Tracking Spreadsheet. What is a Finance Tracking Spreadsheet?. Why you NEED a Finance Tracking Spreadsheet. I do also put small monthly amounts into an ISA and I have a LISA too as mentioned here. However, this is the accurate amount for which the above saving statements have been made on. Additionally, the annual salary stated above does not reflect my salary since being promoted. Note: It may be a while until I invest in my first property but join my journey as I will of course be blogging about my experience from the start with buying-to-let. I have not written this blog to brag but to help you achieve your own saving goals! Admittedly, although my monthly bills are relatively low, I still think this is quite impressive. I have also been able to comfortably pay for my Invisalign treatment and laser eye surgery up front totalling just under £8k. Due to this finance tracking spreadsheet entirely, which I started in December 2018, I have managed to save enough money for a buy-to-let (25%) flat deposit on an annual salary of £23k. This means I am spending approximately only £204.57 per month after bills.

Welcome to my secret behind how I manage to make an average saving of 83.71% of my monthly disposable income (after bills) since October 2019.

0 kommentar(er)

0 kommentar(er)